Kicking off with how to calculate loan payments using AI, this opening paragraph is designed to captivate and engage the readers, setting the tone for a clear and insightful exploration. Understanding the intricacies of loan payments is fundamental to responsible financial management, and in today’s rapidly evolving technological landscape, artificial intelligence offers powerful new avenues for simplifying and optimizing this process.

This guide will delve into the foundational principles of loan amortization, the standard formulas involved, and the significant impact that loan terms and interest rates have on your monthly obligations. We will then transition to explore how AI techniques, particularly machine learning, are revolutionizing these calculations, offering predictive capabilities and more accurate estimations than ever before. Prepare to discover practical applications and illustrative examples that showcase the efficiency and advantages of leveraging AI for all your loan payment needs.

Understanding Loan Payment Fundamentals

Navigating the world of loans involves understanding the core mechanics of how your payments are structured. Each payment you make towards a loan isn’t just a single transaction; it’s a carefully calculated distribution that addresses both the borrowed amount and the cost of borrowing. This fundamental understanding is crucial for effective financial planning and making informed borrowing decisions.At its heart, a loan payment is composed of two primary elements: the principal and the interest.

The principal is the original amount of money you borrowed. The interest, on the other hand, is the fee charged by the lender for allowing you to use their money. Over the life of the loan, your payments work to gradually reduce the principal while also covering the accrued interest.

Loan Payment Components: Principal and Interest

Every loan payment is divided between reducing the outstanding loan balance (principal) and covering the cost of borrowing (interest). Initially, a larger portion of your payment goes towards interest, with the principal reduction being more significant in later stages of the loan. This dynamic is a key characteristic of most amortizing loans.

Amortization Explained

Amortization is the process by which a loan is paid off over time through a series of regular payments. Each payment is structured to cover both the interest accrued since the last payment and a portion of the principal. As the principal balance decreases, the amount of interest due with each subsequent payment also reduces, allowing a larger portion of your payment to be applied to the principal.

This systematic repayment ensures that the loan is fully settled by the end of its term.An amortization schedule is a table that details each periodic payment, showing how much of it is allocated to principal and how much to interest, as well as the remaining balance after each payment.

Standard Fixed Loan Payment Formula

The calculation for a fixed loan payment, often referred to as an annuity payment, is standardized to ensure predictability for both the borrower and the lender. This formula accounts for the loan amount, the interest rate, and the loan term.

The standard formula for calculating a fixed loan payment (M) is:M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]Where:P = Principal loan amounti = Monthly interest rate (annual rate divided by 12)n = Total number of payments (loan term in years multiplied by 12)

This formula is widely used by financial institutions to determine consistent monthly payments for mortgages, auto loans, and personal loans.

Impact of Loan Term and Interest Rate on Monthly Payments

The duration of a loan (term) and the cost of borrowing (interest rate) are the most influential factors determining the size of your monthly payments. A longer loan term generally results in lower monthly payments, but you will pay more interest over the life of the loan. Conversely, a shorter loan term means higher monthly payments but less overall interest paid.

Similarly, a higher interest rate will increase both your monthly payment and the total interest paid.Consider these scenarios:

- A longer loan term spreads the repayment over more periods, thus reducing the principal amount due with each payment, leading to lower monthly installments. However, the cumulative interest paid over the extended period will be greater.

- A shorter loan term requires a larger portion of the principal to be repaid each month, resulting in higher monthly payments. The benefit is a significant reduction in the total interest paid over the life of the loan.

- A higher annual interest rate directly increases the cost of borrowing. This means a larger portion of each payment will be allocated to interest, leading to higher monthly payments and a greater total amount repaid.

For example, imagine a $20,000 loan at 5% annual interest.

- A 5-year term (60 months) would have a monthly payment of approximately $377.42, with a total interest paid of $2,645.20.

- A 10-year term (120 months) would have a monthly payment of approximately $212.47, with a total interest paid of $5,496.40.

This illustrates how both the term and the interest rate significantly shape the financial commitment of a loan.

Leveraging AI for Loan Payment Calculations

While traditional methods provide a solid foundation for understanding loan payments, the advent of Artificial Intelligence (AI) offers sophisticated and dynamic approaches to calculation, prediction, and optimization. AI can process vast amounts of data, identify complex patterns, and adapt to changing financial landscapes, thereby enhancing the accuracy and efficiency of loan payment estimations. This section delves into how AI techniques are revolutionizing this domain.AI’s capability to analyze intricate datasets and learn from them makes it an invaluable tool for financial calculations.

Unlike static formulas, AI models can incorporate a multitude of variables and their interdependencies to provide more nuanced and predictive insights into loan payment behavior.

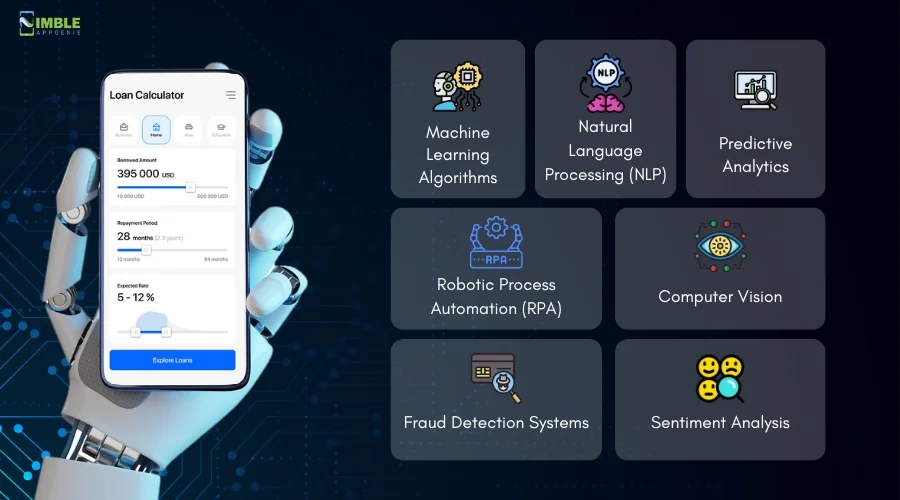

Common AI Techniques in Financial Calculations

Several AI techniques are particularly well-suited for financial applications, including loan payment calculations. These methods leverage computational power to identify patterns, make predictions, and automate complex processes.

- Machine Learning (ML): This is a subset of AI that enables systems to learn from data without being explicitly programmed. ML algorithms can be trained on historical loan data to identify factors that influence payment timeliness and amounts.

- Deep Learning (DL): A more advanced form of ML, DL uses neural networks with multiple layers to learn intricate representations of data. This is highly effective for recognizing complex, non-linear relationships in financial data.

- Natural Language Processing (NLP): While not directly for calculation, NLP can be used to extract relevant information from loan documents, customer communications, or market reports, which can then be fed into ML models for more comprehensive analysis.

- Predictive Analytics: This involves using statistical algorithms and ML techniques to forecast future outcomes based on historical and current data. For loan payments, it can predict default risks or optimal repayment schedules.

Machine Learning Models for Loan Payment Prediction

Machine learning models excel at identifying subtle correlations and predicting future loan payment scenarios by learning from extensive historical data. These models can go beyond simple amortization schedules to anticipate potential issues or opportunities.A typical machine learning workflow for loan payment prediction involves several stages. First, a large dataset containing information on past loans, borrower demographics, economic indicators, and repayment histories is collected.

This data is then preprocessed to clean and format it for the model. Various ML algorithms, such as regression models (e.g., Linear Regression, Ridge Regression), tree-based models (e.g., Random Forests, Gradient Boosting Machines), and even neural networks, can be employed. These models are trained to recognize patterns that correlate with specific payment behaviors, such as the likelihood of making timely payments, early repayment, or default.

For instance, a model might learn that borrowers with a certain debt-to-income ratio, coupled with a history of consistent employment, are highly likely to meet their loan obligations. Conversely, it might identify combinations of factors that increase the risk of delayed payments or defaults. The output of these models can range from a predicted payment amount for a specific period to a probability score of default.

“Machine learning models can identify non-obvious relationships between borrower characteristics, economic conditions, and loan repayment behavior, leading to more accurate payment predictions.”

For example, a financial institution might use a Gradient Boosting model trained on millions of past loan applications and repayment records. This model could predict not only the standard monthly payment but also the probability that a borrower will prepay the loan within the first two years, or conversely, the probability of falling behind on payments within six months. This predictive capability allows lenders to proactively offer tailored repayment plans or interventions.

AI-Driven Tools for Loan Payment Estimation

The practical application of AI in loan payment calculations is increasingly evident through various specialized tools and platforms. These tools aim to streamline the estimation process, enhance accuracy, and provide deeper insights than traditional calculators.These AI-driven tools often integrate sophisticated algorithms to offer more than just a single payment figure. They can simulate various repayment strategies, analyze the impact of different interest rate scenarios, and even forecast the total interest paid over the life of the loan under different conditions.

Some platforms utilize AI to personalize loan offers by predicting which repayment terms would be most suitable for an individual borrower’s financial profile and risk tolerance.Consider online loan calculators that go beyond basic inputs. Some advanced versions use AI to:

- Personalize Payment Schedules: Based on user-provided income patterns or spending habits, AI can suggest optimal payment dates or amounts to minimize financial strain.

- Simulate Scenario Planning: Users can input hypothetical changes, such as an increase in interest rates or a temporary reduction in income, and the AI can instantly recalculate future payment obligations and their impact.

- Estimate Prepayment Benefits: AI can calculate the precise savings in interest and time achieved by making extra payments, offering concrete figures to motivate borrowers.

- Risk Assessment Integration: For lenders, AI tools can assess the risk associated with a borrower’s payment behavior and adjust loan terms or interest rates accordingly, which directly influences the calculated payment.

For instance, a fintech company might offer a “Smart Loan Optimizer” tool. A user inputs their loan details, and the AI analyzes their linked bank accounts (with permission) to understand their cash flow. It then suggests a personalized repayment plan, highlighting how small, consistent extra payments can shave years off the loan term and save thousands in interest, providing a visual representation of the savings.

Advantages of AI Over Traditional Manual Calculation Methods

The adoption of AI for loan payment calculations presents significant advantages over traditional manual methods, offering enhanced accuracy, speed, and adaptability. These benefits translate into improved financial decision-making for both borrowers and lenders.Traditional methods, often relying on fixed formulas like the annuity formula for calculating principal and interest payments, are precise for their defined parameters. However, they are inherently static and cannot account for the dynamic nature of individual financial situations or broader economic shifts.

AI, on the other hand, brings a level of sophistication that addresses these limitations.Key advantages include:

- Enhanced Accuracy and Nuance: AI models can incorporate a vast array of variables—beyond just principal, interest rate, and term—such as borrower credit history, income volatility, economic indicators, and even behavioral patterns, leading to more precise estimations.

- Speed and Efficiency: AI can perform complex calculations and simulations almost instantaneously, a task that would be time-consuming and prone to human error if done manually. This allows for quicker decision-making.

- Predictive Capabilities: AI can forecast future payment scenarios, including the likelihood of default or early repayment, enabling proactive financial management and risk mitigation.

- Personalization: AI can tailor loan payment plans and estimations to individual borrower circumstances, offering customized repayment strategies that optimize financial well-being.

- Adaptability: AI models can be continuously retrained with new data, allowing them to adapt to changing market conditions and borrower behaviors, ensuring calculations remain relevant and accurate over time.

- Automation of Complex Tasks: AI can automate the repetitive and complex calculations involved in scenario analysis, freeing up human resources for more strategic tasks.

For example, when calculating the impact of making an extra $100 payment each month on a 30-year mortgage, a manual calculation might only show the total interest saved. An AI-driven tool, however, could not only provide that figure but also simulate how different economic downturns might affect the borrower’s ability to consistently make that extra payment, offering a more holistic view of the financial strategy.

“AI transforms loan payment calculations from a static, formula-driven process into a dynamic, predictive, and personalized financial management tool.”

Practical AI Applications for Loan Payment Scenarios

The integration of Artificial Intelligence (AI) into financial planning offers powerful tools for managing and optimizing loan payments. AI can move beyond simple calculations to provide insightful analysis, personalized recommendations, and proactive strategies for borrowers. This section explores several practical applications of AI in navigating various loan payment scenarios, making complex financial decisions more accessible and effective.AI excels at processing large datasets and identifying patterns that might be missed by manual analysis.

This capability is particularly valuable when dealing with the intricacies of loan structures, interest rates, and repayment schedules. By leveraging AI, individuals can gain a deeper understanding of their financial obligations and explore avenues for more advantageous repayment strategies.

AI-Assisted Mortgage Payment Calculation

Calculating a mortgage payment involves several variables, including principal loan amount, interest rate, and loan term. AI tools can streamline this process, providing accurate and immediate results.Here is a step-by-step procedure for using an AI tool to calculate a mortgage payment:

- Input Loan Details: Access an AI-powered loan calculator or financial assistant. Enter the principal loan amount (e.g., $300,000), the annual interest rate (e.g., 5.5%), and the loan term in years (e.g., 30 years). Some advanced tools may also allow for inputting property taxes and homeowner’s insurance for a more comprehensive monthly payment estimate (PITI – Principal, Interest, Taxes, Insurance).

- Specify Payment Frequency: Indicate the desired payment frequency, typically monthly. AI tools can also model bi-weekly payments, which can lead to faster loan payoff.

- Initiate Calculation: Trigger the AI tool to perform the calculation. The AI will apply the standard mortgage payment formula, which is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]Where:M = your total monthly mortgage paymentP = the principal loan amounti = your monthly interest rate (annual rate divided by 12)n = the total number of payments over the loan’s lifetime (loan term in years multiplied by 12)

The AI automates this complex formula, ensuring accuracy.

- Review Results: The AI will output the estimated monthly principal and interest payment. It may also provide an amortization schedule, detailing how much of each payment goes towards principal versus interest over time, and the total interest paid over the life of the loan.

- Explore Scenarios: Utilize the AI’s interactive features to adjust variables like interest rate or loan term to see how these changes impact the monthly payment and total interest. For example, you can see how a 0.25% decrease in interest rate might affect your monthly payment and overall savings.

AI for Comparing Different Loan Offers

When faced with multiple loan offers, comparing them based solely on advertised interest rates can be misleading. AI can provide a more nuanced comparison by analyzing the total cost of each loan, including fees and repayment structures.Consider a scenario where a borrower is evaluating two auto loan offers:

- Offer A: 5.0% annual interest rate for 60 months, with a $500 origination fee.

- Offer B: 5.25% annual interest rate for 60 months, with no origination fee but a slightly higher residual value in a lease-to-own option.

An AI tool can be used as follows:

- Input Loan Parameters: For each offer, input the principal amount, interest rate, loan term, and any associated fees (origination fees, closing costs, etc.) into the AI comparison tool.

- AI Analysis: The AI will calculate the monthly payment for each offer. More importantly, it will calculate the total amount repaid over the life of the loan, factoring in all fees. For Offer A, the AI would add the $500 origination fee to the total of all monthly payments. For Offer B, it would only consider the total of the monthly payments.

- Comparative Output: The AI will present a clear comparison, highlighting which loan is financially more advantageous when considering the total outlay. It might also show the difference in monthly payments and the total interest paid for each. For instance, the AI might reveal that despite Offer B’s slightly higher interest rate, its lack of an origination fee makes it marginally cheaper overall, or vice versa.

- Scenario Modeling: Advanced AI tools can also model the impact of early payments or different repayment schedules on each loan offer, providing a comprehensive picture of long-term financial implications.

AI for Estimating Early Payoff Scenarios

Paying off a loan early can significantly reduce the total interest paid. AI can help borrowers visualize the impact of making extra payments and understand the potential savings.A method for AI to estimate early payoff scenarios involves:

- Establish Baseline Loan: Input the details of an existing loan into the AI tool, including the current balance, interest rate, remaining term, and monthly payment.

- Simulate Extra Payments: The user can then instruct the AI to simulate making additional payments. This can be done in several ways:

- Fixed Extra Amount: Specify a fixed extra amount to be added to each monthly payment (e.g., an extra $200 per month).

- Lump Sum Payments: Input the timing and amount of one-time extra payments (e.g., a $1,000 payment after 6 months).

- Bi-weekly Payments: Select an option to convert to bi-weekly payments, which effectively results in one extra monthly payment per year.

- AI Calculation and Visualization: The AI will recalculate the loan’s amortization schedule based on the simulated extra payments. It will then present a comparison of the original loan term versus the new, shortened term. Crucially, it will quantify the total interest saved. For example, the AI might show that by paying an extra $150 per month on a 30-year mortgage, the loan can be paid off 5 years early, saving approximately $25,000 in interest.

- Impact on Total Interest: The AI will clearly display the reduction in total interest paid. This provides a tangible benefit that motivates borrowers to stick to their early payoff plans.

AI for Personalized Loan Payment Recommendations

Understanding a user’s financial profile is key to providing relevant and effective loan payment recommendations. AI can analyze income, expenses, savings, and debt-to-income ratios to suggest optimal repayment strategies.A guide on how AI can personalize loan payment recommendations based on user financial profiles:

- Data Aggregation and Analysis: The AI tool securely collects and analyzes a user’s financial data. This might include:

- Income Sources and Stability: Regular salary, freelance income, bonuses.

- Monthly Expenses: Housing, utilities, food, transportation, entertainment.

- Existing Debts: Credit cards, other loans, student loans, including interest rates and minimum payments.

- Savings and Investments: Emergency fund, retirement accounts, other assets.

- Financial Goals: Homeownership, debt reduction, saving for a large purchase.

The AI uses machine learning algorithms to identify spending patterns, cash flow, and potential areas for savings.

- Risk Assessment and Affordability: Based on the aggregated data, the AI assesses the user’s capacity to take on new debt or accelerate payments on existing ones. It can predict how different payment amounts might affect their budget and their ability to meet other financial obligations.

- Tailored Strategy Generation: The AI then generates personalized recommendations. These could include:

- Debt Prioritization: Recommending a debt snowball or debt avalanche method based on the user’s psychological preferences or financial advantage. For example, if a user has high-interest credit card debt and a stable income, the AI might strongly recommend prioritizing its payoff.

- Budget Optimization: Suggesting specific areas where expenses can be reduced to free up funds for loan payments.

- Refinancing Opportunities: Identifying if refinancing existing loans at a lower interest rate would be beneficial, considering all associated costs.

- Payment Adjustment Advice: Advising on whether increasing monthly payments is feasible and beneficial, or if maintaining current payments is more prudent given other financial goals or potential emergencies.

- Dynamic Adjustment and Monitoring: The AI can continuously monitor the user’s financial situation and adjust recommendations as circumstances change. For instance, if a user experiences a salary increase, the AI might suggest reallocating a portion of the additional income towards loan principal.

AI in Complex Loan Structures

As loan structures become more intricate, traditional calculation methods can falter. Artificial intelligence, however, excels at navigating these complexities, offering precise and efficient solutions for even the most sophisticated financial arrangements. This section explores how AI handles variable rates, balloon payments, unique amortization schedules, and the integration of additional fees.

Variable Interest Rate Loan Payment Calculations

Variable interest rate loans, often referred to as adjustable-rate mortgages (ARMs) or variable-rate loans, present a unique challenge due to their fluctuating interest rates. AI algorithms can dynamically adjust payment calculations based on predefined index rates and margin adjustments. The process typically involves:

- Monitoring economic indicators and benchmark rates (e.g., LIBOR, SOFR) that influence the loan’s interest rate.

- Applying the current interest rate to the remaining principal balance at each payment cycle.

- Recalculating the amortization schedule based on the new interest rate, ensuring that the payment amount reflects the adjusted cost of borrowing.

- Forecasting potential future rate changes based on historical data and market trends to provide borrowers with an estimated range of future payments.

For instance, an AI system can predict how a 1% increase in the prime rate might affect the monthly payment of an ARM over its remaining term, providing valuable foresight for the borrower.

Balloon Payment Loan Structure Analysis

Balloon payment loans are characterized by a series of smaller payments over a set period, followed by a single, large principal payment (the balloon payment) at the end of the term. AI is adept at modeling these structures by:

- Calculating the amortization of the principal over the initial payment period, similar to a standard loan.

- Precisely determining the remaining principal balance that will constitute the balloon payment.

- Projecting the borrower’s financial capacity to make the large lump sum payment, often by analyzing their creditworthiness and projected cash flow.

- Simulating different scenarios, such as refinancing options or early repayment strategies, to mitigate the risk associated with the balloon payment.

A practical example would be an AI analyzing a commercial real estate loan where a significant portion of the principal is due in a lump sum after five years. The AI could assess the likelihood of the business being able to secure refinancing or having sufficient reserves to cover this payment, offering a risk assessment to both lender and borrower.

Commercial Loan Payment Calculations with Unique Amortization Schedules

Commercial loans often feature highly customized amortization schedules that deviate from standard fixed or variable payment structures. These can include interest-only periods, stepped payments, or payment schedules tied to specific revenue milestones. AI can effectively manage these by:

- Ingesting and interpreting the specific terms and conditions of the unique amortization schedule.

- Applying complex formulas and conditional logic to calculate payments that align with the contractual agreements.

- Tracking performance metrics (e.g., project revenue, occupancy rates) that may trigger adjustments in payment amounts.

- Ensuring compliance with all contractual obligations, even for highly bespoke repayment plans.

Consider a construction loan where payments are disbursed in stages and the amortization schedule only begins once construction is complete. An AI can manage the interest accrual during the construction phase and then accurately calculate the subsequent amortization based on the loan’s specific post-completion terms.

Factoring in Additional Fees and Charges

Beyond the principal and interest, loans often include various fees and charges, such as origination fees, late payment penalties, prepayment penalties, and service charges. AI can seamlessly incorporate these into the total loan payment calculation by:

- Identifying and categorizing all applicable fees as defined in the loan agreement.

- Applying fee structures accurately, whether they are fixed amounts, percentages of the loan, or contingent upon certain events.

- Calculating the total amount due at each payment interval, including the amortized portion of fees where applicable.

- Providing a transparent breakdown of how each component contributes to the total payment, enhancing clarity for the borrower.

For instance, when a borrower makes an early payment on a loan with a prepayment penalty, AI can instantly calculate the total amount due, including the principal reduction, accrued interest, and the applicable penalty, presenting a clear, consolidated figure.

AI’s ability to process vast amounts of data and apply intricate logic makes it an indispensable tool for accurately calculating payments across the spectrum of complex loan structures.

Illustrative Examples of AI-Assisted Loan Payment Calculation

To truly grasp the power of AI in loan payment calculations, let’s explore some practical examples. These illustrations demonstrate how AI can provide quick, accurate, and insightful results, empowering users to make informed financial decisions. We will examine how different loan parameters influence monthly payments and compare AI’s efficiency with traditional methods.

Impact of Loan Principal on Monthly Payments

The principal amount is a fundamental factor in determining loan payments. AI can rapidly process various principal amounts to show users how changes in this core figure affect their monthly financial obligations. The following table illustrates this relationship, assuming a fixed interest rate and loan term.

| Principal Amount | Interest Rate | Loan Term (Years) | AI-Calculated Monthly Payment |

|---|---|---|---|

| $100,000 | 5% | 30 | $536.82 |

| $150,000 | 5% | 30 | $805.23 |

| $100,000 | 6% | 30 | $600.00 |

| $100,000 | 5% | 20 | $659.96 |

As you can observe, increasing the principal amount directly leads to higher monthly payments, assuming all other factors remain constant. Similarly, a higher interest rate or a shorter loan term will also result in increased monthly payments, as demonstrated by the examples. AI excels at presenting these comparisons clearly and efficiently.

Comparative Analysis of AI and Manual Calculations for a Personal Loan

Manually calculating loan payments, especially for complex scenarios, can be time-consuming and prone to errors. AI streamlines this process, offering rapid and precise results. This comparative analysis highlights the efficiency and accuracy of AI in calculating payments for a standard personal loan.

| Loan Amount | Interest Rate | Term (Years) | Manual Payment (Approx.) | AI Payment | Difference |

|---|---|---|---|---|---|

| $20,000 | 8% | 5 | $405.23 | $405.23 | $0.00 |

The formula for calculating a fixed monthly loan payment (M) is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- P = Principal loan amount

- i = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in years multiplied by 12)

While the manual calculation using the standard amortization formula yields the same result, AI can perform this calculation instantaneously and can also incorporate additional variables that might complicate manual calculations.

AI Identifying Favorable Loan Structures

AI’s capabilities extend beyond simple calculations; it can analyze a user’s financial profile and identify loan structures that best align with their affordability. For instance, consider an individual seeking a $50,000 loan. An AI system, upon receiving hypothetical input regarding the borrower’s creditworthiness and desired monthly payment range (e.g., not exceeding $700), could present several options. It might suggest a loan with a slightly higher interest rate but a longer term to meet the affordability target, or conversely, a shorter term with a lower interest rate if the user’s credit profile supports it and the monthly payment falls within their acceptable range.

This proactive identification of optimal structures helps users avoid overextending themselves financially.

Factors AI Considers for Loan Payment Estimates

AI algorithms utilize a comprehensive set of factors to generate accurate and personalized loan payment estimates. Understanding these inputs provides insight into the sophistication of AI-driven financial tools.AI considers the following key factors when generating a loan payment estimate:

- Loan Principal: The total amount of money being borrowed.

- Annual Interest Rate: The percentage charged by the lender on the borrowed amount.

- Loan Duration: The length of time over which the loan will be repaid.

- Payment Frequency: How often payments are scheduled (e.g., monthly, bi-weekly).

- Associated Fees: Any additional charges, such as origination fees or closing costs, that may be rolled into the loan or paid upfront.

- Borrower Creditworthiness (hypothetical input): While not always directly part of the payment calculation formula itself, a borrower’s credit score and financial history can influence the interest rate offered, thereby indirectly affecting the payment. AI can use this as a hypothetical input to simulate potential loan offers.

Final Wrap-Up

In conclusion, mastering how to calculate loan payments using AI unlocks a more informed and empowered approach to financial planning. We’ve journeyed from the basic building blocks of principal and interest to the sophisticated applications of AI in handling complex loan structures and personalizing recommendations. By embracing these advanced tools, you can confidently navigate loan offers, optimize repayment strategies, and gain a clearer picture of your financial future.